Staying ahead of the competition is critical for any business aiming to succeed in today’s fast-paced market. With new players constantly entering the field and existing ones upping their game, it’s essential to have your finger on the pulse of the competitive landscape.

Competitive analysis allows you to identify your direct and indirect competitors, understand their strategies and offerings, and use those insights to refine your own business practices for greater success. Whether you’re looking to launch a new product, adjust pricing, revamp marketing campaigns, or make key strategic decisions, having in-depth knowledge of the competition is key.

In this comprehensive guide, I will provide actionable tips and data-driven insights to help you master the art and science of competitive analysis. Let’s get started!

Table of Contents

Current Landscape: The Evolution of Competitive Analysis

Not too long ago, gauging competition involved manual research and basic comparison of factors like price and core features. Today, technology and the availability of data have revolutionized competitive analysis.

- According to Harvard Business Review, 79% of companies leverage data analytics for competitive analysis today.

Some key trends include:

- Integration of AI and ML: Advanced algorithms help automate competitor monitoring and quickly process large datasets.

- Focus on customer intelligence: Feedback, reviews and usage patterns provide insight into competitors’ strengths and weaknesses.

- Emergence of SaaS solutions: Platforms like Competitive 360 simplify tracking and analysis with custom dashboards.

- Emphasis on real-time monitoring: Daily tracking of competitors via news alerts, social media, and review sites.

Forward-thinking businesses are realizing the importance of adapting to these developments for timely, in-depth competitive insights.

Mapping the Competitive Landscape

The first step is identifying your competitors. This involves categorizing them into:

Direct Competitors

These are businesses offering similar products/services targeting the same customers. For example, Pepsi and Coca-Cola.

Indirect Competitors

Businesses that offer different but substitute products/services. For example, Coke and fruit juices.

Cast a wide net in this process. You might gain valuable perspective from an unexpected arena.

Conducting Competitor Research

With your competitive set identified, dive deeper with research on:

- Core offerings: Product/service features, variations, patents, and new launches.

- Pricing models: Price points, discounts, bundling strategies, and payment plans.

- Marketing and messaging: Value proposition, brand personality, advertisements, and key messages.

- Online reputation and reviews: Sentiment analysis and identifying pain points.

- Revenue and founders: Funding details, investor information, and leadership profiles.

Aim to uncover their priorities, strengths, weaknesses, and strategic direction.

Helpful Places to Research

- Competitor’s website, blogs, press releases

- Review sites like G2, Trustpilot

- Market research reports from agencies like Gartner

- Public records including funding details and trademarks

- Social media channels and marketing campaigns

Gauging Market Share

Analyzing financial statements, industry rankings, and sales data can provide objective insight into competitors’ market share.

For private companies, tools like SimilarWeb, Buzzsumo, and SEMrush estimate traffic metrics. Or use Google Trends to compare search volume and interest over time.

Understanding market share distribution helps strategize your positioning. Gaps where competitors are falling short present opportunities for you to excel.

Leveraging Technology for Competitive Intelligence

Sifting through massive amounts of data to derive meaningful insights can prove challenging without the right tools.

Here are some technologies making competitive analysis more effective and efficient:

- AI-powered market research: Companies like Temai and Crayon automate data collation from various sources and provide customized analysis.

- Predictive analytics: Reveal future trends and direction based on current traction.

- Big data capabilities: Uncover connections between scattered data points.

- Automated monitoring: Get real-time alerts on website changes, new products, marketing campaigns, sentiment fluctuations and more for quick monitoring.

According to Gartner, analytics and AI could save companies $16 billion annually in improved productivity and strategic decision making.

The key is choosing tools aligned with your business goals and competitive intelligence needs. Invest time testing different options to see which one provides maximum ROI.

Turning Insights into Action

The most successful competitor analysis initiatives translate data into strategic action. Here are some ways to drive measurable impact:

Enhance Products and Services

Identify product gaps that competitors haven’t addressed. Use reviews and customer intelligence to pinpoint frustrating pain points you can eliminate.

Example: JetBlue created Mint class and lie-flat seats to capture underserved premium travellers, gaining advantage over competitors.

Sharpen Pricing Strategies

Competitor pricing models provide a benchmark to inform your own – but don’t just match them. Be strategic based on your positioning and cost structures.

Monitor changes and run experiments to maximize revenue.

Refine Marketing Campaigns

Knowing competitors’ messaging and campaigns allows you to differentiate your brand. Identify untapped channels or underserved demographics.

Uncover Partnership Opportunities

Your competitor’s partner is not off limits. Companies like Starbucks and Spotify have partnered despite some product overlap.

Make Strategic Business Decisions

M&A, expansion, new market entry, raising capital – competitive intelligence should inform these pivotal calls. Forecast future moves and simulate scenarios.

An estimated 70% of M&A failures are due to lack of comprehensive due diligence across business units. Avoid this fate.

Monitoring Customer Conversations

Your competitors’ customers can be a goldmine of actionable intel. Here are some proven approaches to glean insights from their experiences:

- Run polls and surveys with strategic questioning to reveal their priorities, likes/dislikes and buying factors.

- Analyze reviews and testimonials on social media and third-party sites. Look for recurring themes.

- Speaking with customers in focus groups can uncover honest opinions and insights surveys alone might miss.

- Monitor support conversations on forums and social media to identify recurring complaints and concerns.

Pro Tip: Set up Google Alerts and social listening streams to automatically track mentions of competitors for regular monitoring.

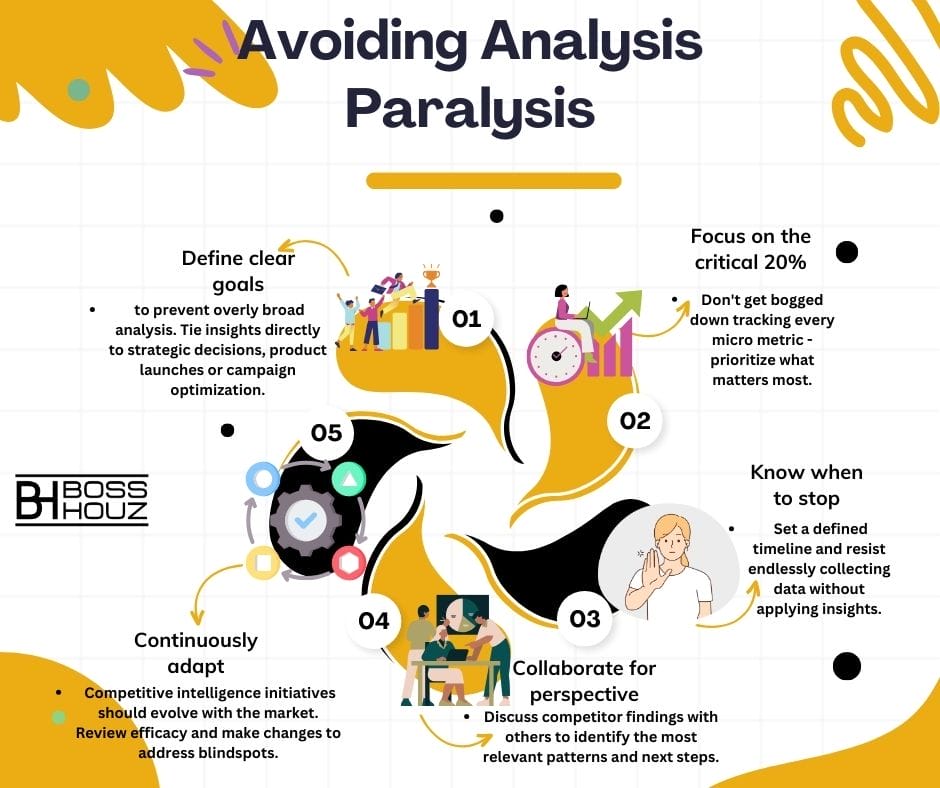

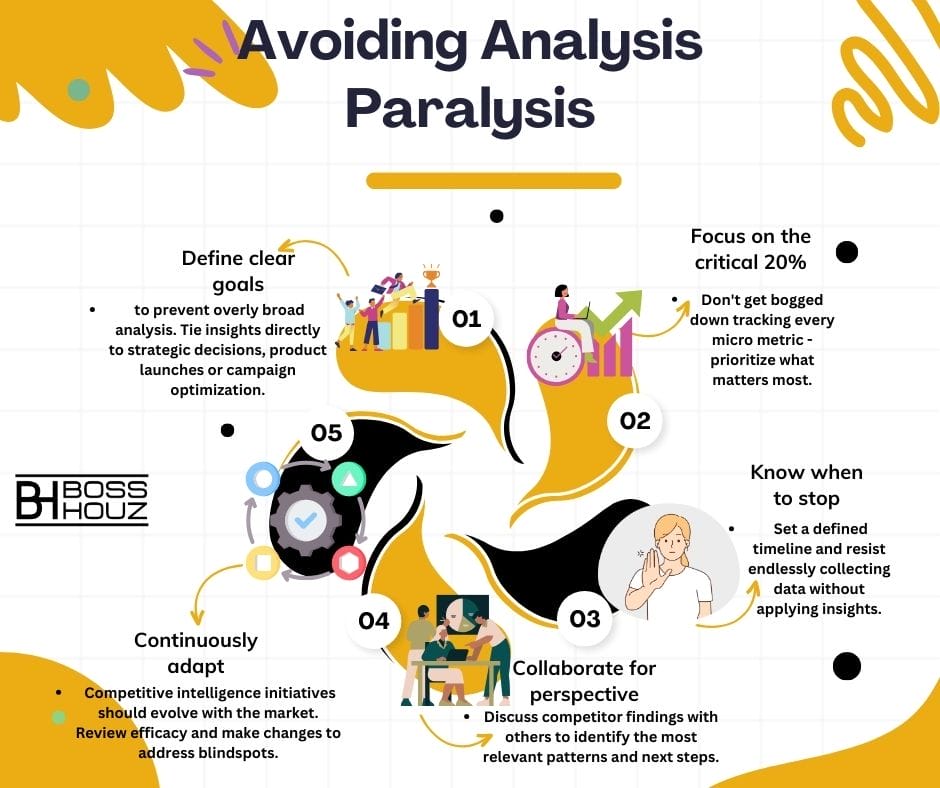

Avoiding Analysis Paralysis

With so much data at your fingertips, paralysis by analysis is a real concern.

- Define clear goals to prevent overly broad analysis. Tie insights directly to strategic decisions, product launches or campaign optimization.

- Focus on the critical 20%. Don’t get bogged down tracking every micro metric – prioritize what matters most.

- Know when to stop. Set a defined timeline and resist endlessly collecting data without applying insights.

- Collaborate for perspective. Discuss competitor findings with others to identify the most relevant patterns and next steps.

- Continuously adapt. Competitive intelligence initiatives should evolve with the market. Review efficacy and make changes to address blindspots.

The Future of Competitive Analysis

As technology progresses, data acquisition and analysis will only become faster, more comprehensive and precise.

- AI-driven automation will likely expand, from data gathering to predictive recommendations.

- Augmented analytics could overlay key insights onto real environments via AR. Imagine seeing a competitor’s ad spend as you walk by a billboard!

- Data mesh architectures will make intel sharing and analysis easier across business units.

But machines alone cannot replicate human judgment, critical thinking and domain expertise. The future likely holds tech-empowered teams leveraging the best of both worlds.

Analyzing Your Competition In Closing

With the right competitive intelligence strategy and initiative in place, you are well-equipped to out maneuver the competition. Stay vigilant in your research, open to new technologies, but focused on timely action based on insights extracted.

Companies realizing maximum business impact know competitive analysis is not a one-and-done effort, but rather an ongoing rhythm that touches all aspects of the business. They see it as an investment, not a cost, and a key driver of growth.

Thank you for reading! Please share any experiences or questions on effectively using competitive analysis to gain an edge. I look forward to helping with any specific challenges you face in this crucial endeavor.

Here’s to your business’s continued success!