Have you ever considered putting your accounting skills to use outside of your 9-5 job to make some extra cash? With the right side hustle, accountants can easily leverage their expertise to supplement their income. From bookkeeping services to tax prep, the options are plentiful.

This article will explore some of the best side hustle opportunities for accountants that offer flexibility, high earning potential, and a way to expand your professional opportunities. Whether you’re looking to pad your savings or make a career transition, these accounting side hustles are worth exploring.

Table of Contents

Why Consider an Accounting Side Hustle?

Before diving into the specific ideas, let’s look at some of the key reasons why an accounting side hustle is worth pursuing:

Make Extra Money

Most side hustles provide the opportunity to make an extra $1,000+ per month by working just 5-10 extra hours per week. This added income can help you pay down debt faster, boost your savings, or fund personal goals.

Build Expertise

By taking on side projects, you expand your skills and knowledge into new areas of accounting and business. This looks great on your resume and keeps your skills sharp for career advancement.

Explore New Passions

For many accountants, a side hustle offers the flexibility to explore alternate career paths they’re passionate about but haven’t pursued, like financial consulting or tax advising. It lets you dip your toes in the water before making a big career switch.

Enjoy Work-Life Balance

The work-from-home nature of most accounting side hustles means you can choose your own hours and work around your schedule. This flexibility and control over your time is invaluable.

Help People

Whether it’s saving a small business owner money on their taxes or helping an individual properly plan for retirement, many accounting side hustles allow you to make a real positive impact.

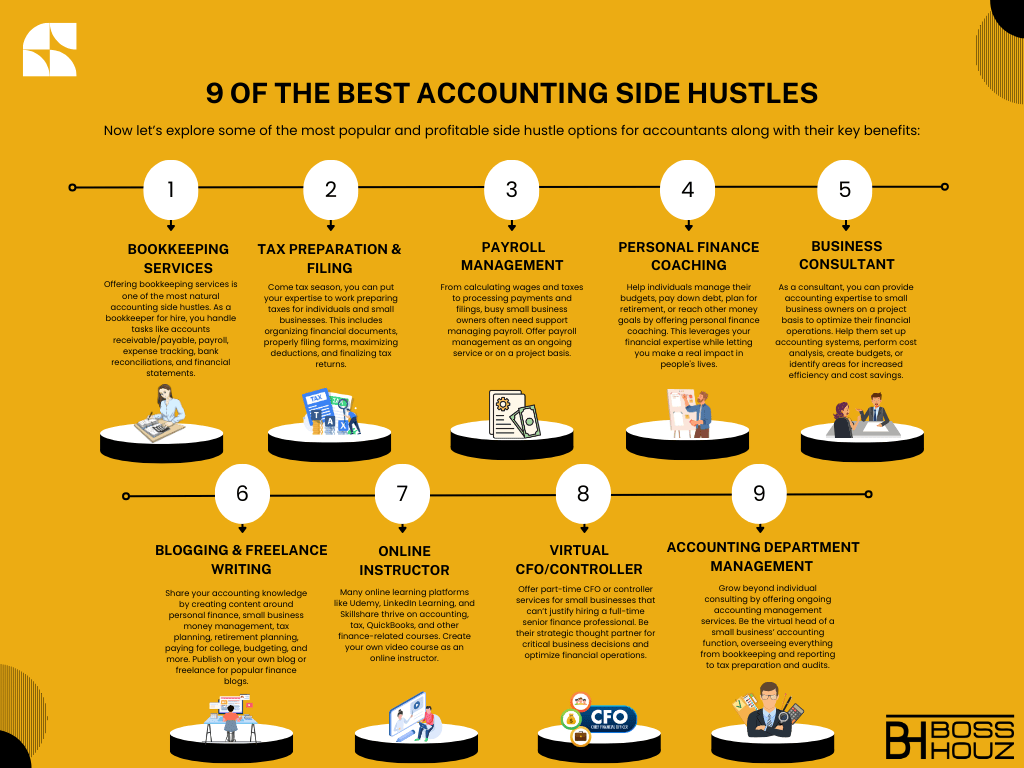

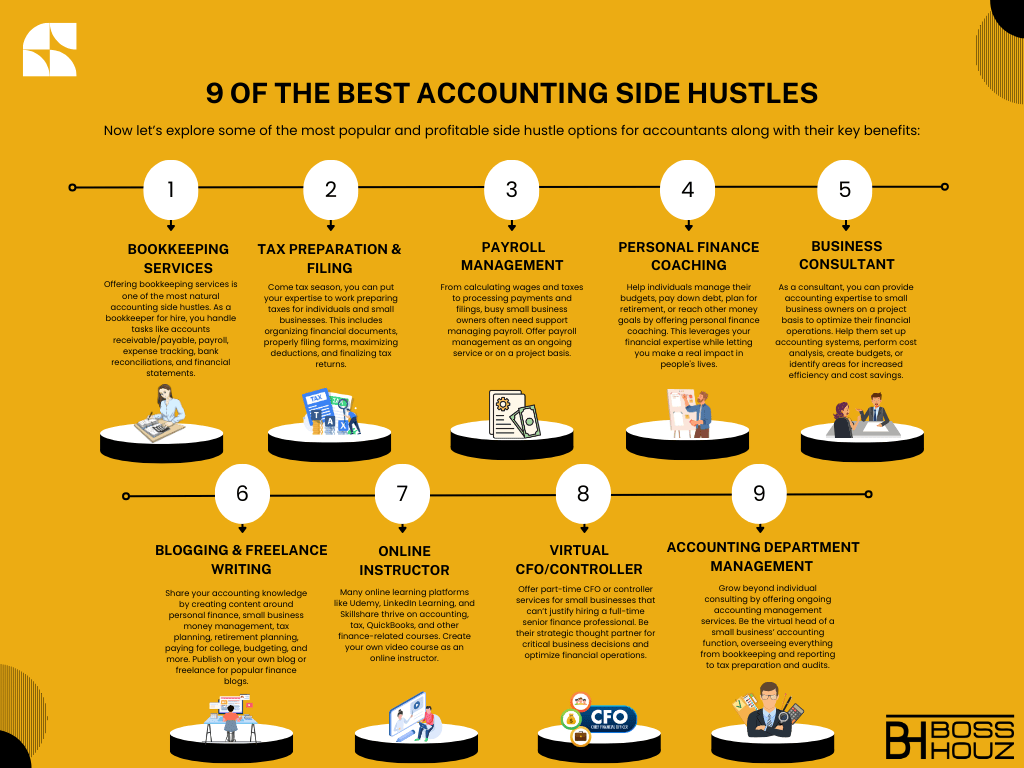

9 of the Best Accounting Side Hustles

Now let’s explore some of the most popular and profitable side hustle options for accountants along with their key benefits:

1. Bookkeeping Services

Offering bookkeeping services is one of the most natural accounting side hustles. As a bookkeeper for hire, you handle tasks like accounts receivable/payable, payroll, expense tracking, bank reconciliations, and financial statements.

Income Potential: $30-$60 per hour (Source)

Key Benefits

- Leverage your existing skills

- Flexible work-from-home arrangement

- Large market need for freelance bookkeepers

- Easy to get new clients through online freelance platforms

2. Tax Preparation & Filing

Come tax season, you can put your expertise to work preparing taxes for individuals and small businesses. This includes organizing financial documents, properly filing forms, maximizing deductions, and finalizing tax returns.

Income Potential: $200-$1000+ per tax return depending on complexity (Source)

Key Benefits

- Very flexible, seasonal side hustle

- Higher income potential during tax season

- Gain useful tax knowledge helping diverse clients

- Manage your own client portfolio and pricing

3. Payroll Management

From calculating wages and taxes to processing payments and filings, busy small business owners often need support managing payroll. Offer payroll management as an ongoing service or on a project basis.

Income Potential: $200+ per month per client (Source)

Key Benefits

- Leverage your understanding of accounting systems, taxes, and compliance

- Ongoing relationship provides steady extra income

- Cloud-based payroll software makes it easy to manage payroll virtually

4. Personal Finance Coaching

Help individuals manage their budgets, pay down debt, plan for retirement, or reach other money goals by offering personal finance coaching. This leverages your financial expertise while letting you make a real impact in people’s lives.

Income Potential: $60-$150 per hour (Source)

Key Benefits

- Very flexible engagement model

- Hourly coaching fees add up quickly

- Opportunity to specialize your services

- Leverages your passion for helping people

5. Business Consultant

As a consultant, you can provide accounting expertise to small business owners on a project basis to optimize their financial operations. Help them set up accounting systems, perform cost analysis, create budgets, or identify areas for increased efficiency and cost savings.

Income Potential: $100-$250 per hour (Source)

Key Benefits

- Variety of potential projects to choose from

- Flexibility to work with multiple clients

- Opportunity to help small business owners succeed

- Projects can be very lucrative

6. Blogging & Freelance Writing

Share your accounting knowledge by creating content around personal finance, small business money management, tax planning, retirement planning, paying for college, budgeting, and more. Publish on your own blog or freelance for popular finance blogs.

Income Potential: $200-$500 per blog post (Source)

Key Benefits

- Turn your passion for writing into extra income

- Build authority and amplify your expertise

- Very flexible work arrangement

- Great way to expand your professional network

7. Online Instructor

Many online learning platforms like Udemy, LinkedIn Learning, and Skillshare thrive on accounting, tax, QuickBooks, and other finance-related courses. Create your own video course as an online instructor.

Income Potential: $250-$2,000+ per course (Source)

Key Benefits

- Share your specialized knowledge

- Courses can provide passive income for years

- Establish yourself as an authority in your niche

- Flexible way to teach and scale your impact

8. Virtual CFO/Controller

Offer part-time CFO or controller services for small businesses that can’t justify hiring a full-time senior finance professional. Be their strategic thought partner for critical business decisions and optimize financial operations.

Income Potential: $4,000-$10,000 per month (Source)

Key Benefits

- Leverage your advanced accounting expertise

- Build strategic leadership experience

- High income potential for your credentials

- Flexible work-from-home arrangement

9. Accounting Department Management

Grow beyond individual consulting by offering ongoing accounting management services. Be the virtual head of a small business’ accounting function, overseeing everything from bookkeeping and reporting to tax preparation and audits.

Income Potential: $2,500-$7,500 per month (Source)

Key Benefits

- Provide essential business infrastructure as an outsourced department

- Ongoing relationship with lucrative monthly fees

- Virtual work arrangement

- Leverages the full spectrum of your accounting skills

Comparison Table

| Side Hustle | Earning Potential (1-10) | Ease to Start (1-10) | Difficulty to Manage (1-10) |

| Bookkeeping Services | 6 | 8 | 5 |

| Tax Preparation & Filing | 8 | 5 | 4 |

| Payroll Management | 6 | 7 | 6 |

| Personal Finance Coaching | 7 | 7 | 5 |

| Business Consultant | 8 | 5 | 4 |

| Blogging & Freelance Writing | 6 | 8 | 6 |

| Online Instructor | 7 | 6 | 7 |

| Virtual CFO/Controller | 10 | 4 | 5 |

| Accounting Department Management | 9 | 3 | 5 |

Analysis:

- Bookkeeping Services: Moderate earning potential with high ease of start due to widespread demand and relatively straightforward management.

- Tax Preparation & Filing: High earning potential, especially seasonally; moderate start-up difficulty due to need for expertise and certification; somewhat easier to manage once clients are established.

- Payroll Management: Steady income potential, relatively easy to start with automated tools, moderate difficulty in managing due to ongoing client interaction and updates in tax laws.

- Personal Finance Coaching: Good earning potential with flexible work, fairly easy to start and manage as sessions are often scheduled and structured.

- Business Consultant: High earning potential on a project basis, moderate difficulty to start and manage depending on client needs and project scope.

- Blogging & Freelance Writing: Moderate earning potential; relatively easy to start, especially on established platforms; ongoing content creation can make it somewhat demanding to manage.

- Online Instructor: Good potential for passive income after initial setup, moderate to start as it requires significant upfront effort in creating quality content.

- Virtual CFO/Controller: Very high earning potential with advanced expertise required; more challenging to start due to the need for high-level trust and credibility; ongoing management is complex but manageable.

- Accounting Department Management: High earning potential through ongoing client relationships; challenging to start as it requires comprehensive service offerings; moderate difficulty in management due to continuous oversight required.

Getting Started With an Accounting Side Hustle

If one or more of these accounting side hustle ideas appeals to you, here’s a quick checklist to prepare for launch:

Brush up on technical skills

Make sure your skills are sharp in relevant areas like bookkeeping software, tax codes, payroll systems, etc. Consider taking a short course or online bootcamp if you need a quick refresher.

Create business collateral

Develop essentials like your website, service menus, price lists, legal agreements, etc. This helps you appear professional right out the gate.

Get licensed

Some services may require special licensing or credentials, like tax preparation and bookkeeping. Make sure you have what’s needed legally before promoting your services.

Establish a business entity

Form an LLC or S-Corp to separate your side hustle income and expenses from your personal finances. This also projects credibility with clients.

Define your niche

Determine what types of clients or specialty services you want to focus on. This could be based on previous industry experience, specialized knowledge, or passions outside of work. Positioning yourself as a niche expert can attract clients fast.

Offer free consultation calls

To land your first few clients quickly, consider offering free 30-minute consultation calls to demonstrate your services and close deals. This “try before you buy” approach works extremely well.

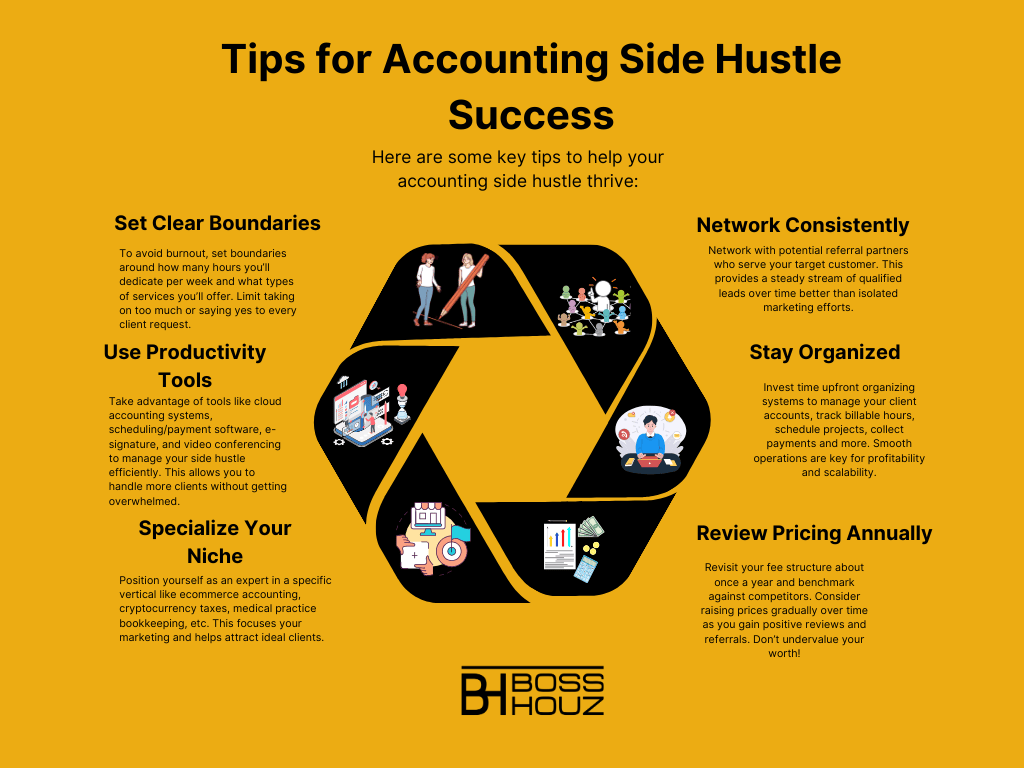

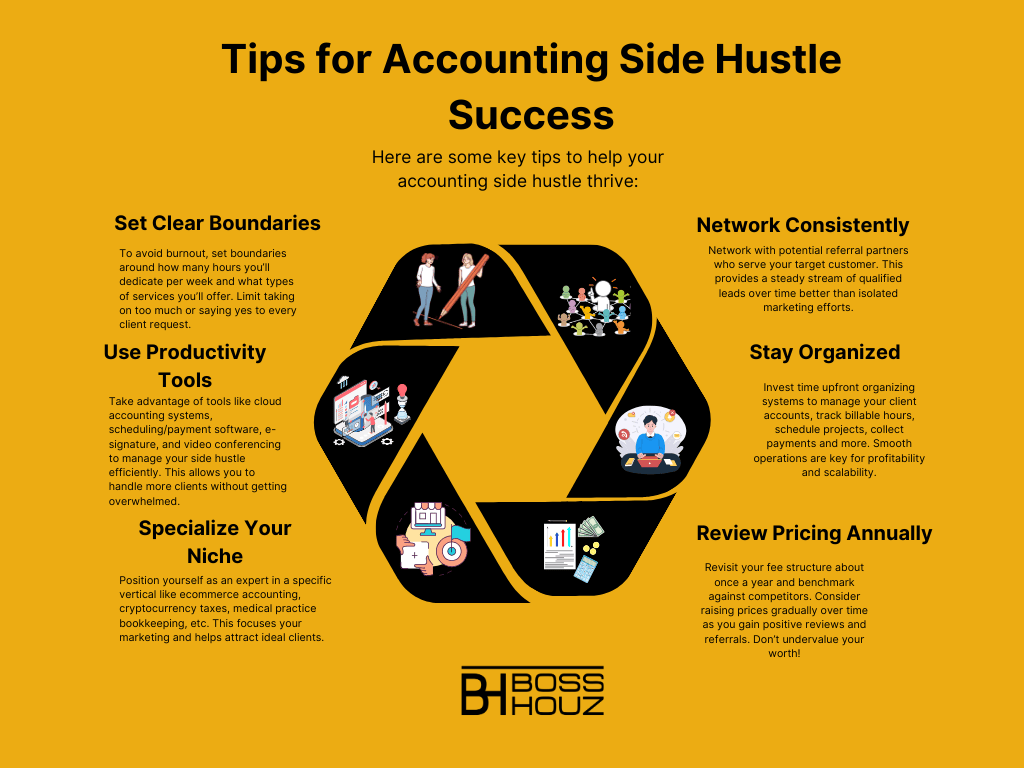

Tips for Accounting Side Hustle Success

Here are some key tips to help your accounting side hustle thrive:

Set Clear Boundaries

To avoid burnout, set boundaries around how many hours you’ll dedicate per week and what types of services you’ll offer. Limit taking on too much or saying yes to every client request.

Use Productivity Tools

Take advantage of tools like cloud accounting systems, scheduling/payment software, e-signature, and video conferencing to manage your side hustle efficiently. This allows you to handle more clients without getting overwhelmed.

Specialize Your Niche

Position yourself as an expert in a specific vertical like ecommerce accounting, cryptocurrency taxes, medical practice bookkeeping, etc. This focuses your marketing and helps attract ideal clients.

Network Consistently

Network with potential referral partners who serve your target customer. This provides a steady stream of qualified leads over time better than isolated marketing efforts.

Stay Organized

Invest time upfront organizing systems to manage your client accounts, track billable hours, schedule projects, collect payments and more. Smooth operations are key for profitability and scalability.

Review Pricing Annually

Revisit your fee structure about once a year and benchmark against competitors. Consider raising prices gradually over time as you gain positive reviews and referrals. Don’t undervalue your worth!

FAQs About Accounting Side Hustles

If you’re considering an accounting side hustle, you likely have some questions about the specifics. Here are answers to some frequently asked questions:

What accounting skills do I need?

This varies by the type of services offered. But commonly demanded skills include bookkeeping, tax preparation, payroll administration, QuickBooks, budgeting/forecasting, financial reporting, and general business advisory. Any specialization helps attract clients.

How much can I earn with these side hustles?

Income potential ranges quite a bit based on your niche, experience level, credentials, client types, and ability to scale. But generally you can expect to earn an extra $1,000-$3,000 per month working 5-15 hours per week. With the right client portfolio and efficiency systems, six-figures is achievable.

What are the tax implications?

Accounting side hustle income constitutes self-employment income. So you need to pay estimated quarterly taxes on your earnings and file a Schedule C at tax time documenting income and expenses. An accountant can ensure you stay compliant.

Do I need any special licensing?

For simpler services like bookkeeping and consulting, no special licensing is typically required beyond registering your business locally. But for regulated activities like tax preparation and payroll, specific credentials or licenses will be mandatory even for side hustles. Do your homework on requirements.

How do I find clients?

Start by tapping into your existing network and social media connections. Offer free consultations to secure referrals. As you build experience, create a website, optimize SEO, and list your services on freelance marketplaces. Consider pay-per-click ads. Guest posting for popular accounting blogs also attracts clients.

Can I keep my full-time job?

Most side hustles are specifically designed to be flexible enough for those working a regular 9-5 job. By setting boundaries and leveraging productivity tools, you can easily accommodate 10-15 extra hours per week without burning out. Just focus on providing high-value services rather than maximizing client volume. Say no if it ever becomes too much!

Wrapping Up: An Accounting Side Hustle Puts Your Skills to Optimal Use

Rather than keeping your accounting expertise locked up to benefit your day job employer alone, put it to work on your own terms with a strategic side hustle tailored to your passions.

Not only can you substantially grow your income, but you might just find a new calling that inspires a career change down the road. At minimum, you expand your skill set and network.

So if you feel stuck at your current job with untapped potential, give one of these accounting side hustle ideas serious consideration. With some hustle on the side, you can build skills, income streams, and professional opportunities that transform your career trajectory.

What accounting side hustle most appeals to you and why? Share your thoughts in the comments!