Running a small business is no easy feat. Between managing inventory, employees, marketing efforts, and overall operations, business finances often get pushed aside. However, according to Intuit QuickBooks, 82% of small business failures are due to poor cash management and financial controls. This highlights the importance of proper financial management for small business success.

While many new entrepreneurs try to handle bookkeeping themselves initially, most find themselves overwhelmed as responsibilities pile up. Hiring a bookkeeper allows small business owners to focus their energy on higher-level tasks while ensuring accuracy and compliance in financial record keeping. But finding the right bookkeeper takes some consideration regarding your business’s specific needs and stage of growth.

This article will guide you through the key aspects of assessing your bookkeeping requirements, choosing between bookkeeping solutions, hiring the ideal candidate, and setting up an efficient ongoing system. By investing some time upfront in finding a bookkeeper tailored to your small business, you can reap significant rewards down the road through data-driven decisions, minimized tax liabilities, and controlled operating costs.

Table of Contents

Understanding the Role of a Bookkeeper

Before diving into the hiring process, it’s important to understand exactly what a bookkeeper does. While often used interchangeably with accountants, the roles differ significantly.

Bookkeepers track day-to-day financial transactions, update accounts, reconcile discrepancies, process payroll, file taxes, and prepare financial statements. In essence, they organize financial records and ensure the “books” are balanced. Bookkeepers tend to provide fairly routine (yet business-critical) services.

Accountants analyze financial reports, advise on business growth opportunities, ensure compliance with accounting regulations, audit books, and guide complex processes like valuations or investments. The accountant role is more strategic and advisory based on in-depth financial analysis.

For most small businesses, a bookkeeper meets the bulk of daily financial needs, with an accountant providing periodic high-level insights and tax preparation. Understanding these distinct roles helps pinpoint the required skills and services when hiring.

The Importance of Bookkeeping for Small Businesses

Proper financial record keeping provides the foundation for small business success by enabling:

- Accurate financial reporting: Well-organized books allow business owners to pull essential financial reports like income statements, balance sheets, cash flow statements, and tax forms. These documents inform critical decisions and strategy.

- Tax and compliance optimization: Detailed bookkeeping minimizes tax liabilities, prevents penalties from missed deadlines or errors, and demonstrates financial diligence if ever audited.

- Funding opportunities: Investors want to see accurate historical finances before committing capital, while lenders require solid record-keeping to secure loans.

In short, quality bookkeeping isn’t just paperwork but directly impacts small business performance. It provides clarity into where money comes from and goes to ultimately drive growth and sustainability.

When to Hire a Bookkeeper

Most entrepreneurs handle basic bookkeeping tasks themselves initially. However, consider hiring professional help when:

- Transactions multiply beyond tracking in a simple spreadsheet

- Keeping books takes >10 hours a week

- You begin struggling with errors and discrepancies

- You expand locations, inventory, or staff

- You incorporate more complex operations like manufacturing

- You prepare to seek financing

“Think carefully about when your business merits hiring help. The right bookkeeper saves you time, gives financial clarity, and often pays for itself through optimized taxes and financing terms.”

Essentially, if financial records become chaotic, that chaos will spill into overall operations. Be proactive bringing in help before the problem compounds.

Options for Hiring a Bookkeeper

Fortunately for small business owners, bookkeeping is no longer a “one-size-fits-all” proposition. Advances in software and remote work access means defining a solution customized to your needs and budget. Typical setups include:

In-House Bookkeepers

Hiring an internal employee offers maximum oversight and control for more complex business needs. Best for mid-sized operations with steady transaction volumes.

| Pros | Cons | Average Cost |

| Full attention on your company | Salary and benefits increase labor costs | $30,000 – $70,000 salary |

| Integrates into company culture and systems | Additional HR responsibilities | |

| Works normal business hours onsite | Lack specialized industry experience |

Freelance Bookkeepers

Independent bookkeepers work on contract, allowing you to define specific services required. Provides targeted expertise often at lower costs.

| Pros | Cons | Average Cost |

| Pay only for services rendered | Communication overhead | $30 – $100+/hour |

| Access specialized capabilities | Multiple clients = divided attention | |

| Flexible availability | Contract management required |

Virtual Bookkeeping Firms

Firms provide teams specializing by industry and service (payroll, AP/AR) and leveraging software for remote access.

| Pros | Cons | Average Cost |

| Gain a team’s experience | Contract minimums may be higher | $125 – $300+/month |

| Specialized by industry and service | Less personalized service | |

| Tech-enabled remote capabilities | Communication flows through account manager |

Accounting Software

Recent advances allow some software to automate basic bookkeeping tasks. Ideal for early-stage businesses with simple needs.

| Pros | Cons | Average Cost |

| Low monthly fees | Limited to basic bookkeeping | $10 – $100+/month |

| Easy to set up and scale | Still need manual data inputs | |

| Many integrate with POS systems | Lack strategic accounting insights |

Evaluate these options against your business’ current size, industry, transaction volume, growth plans, and budget. A good rule of thumb is to size your solution to expected needs 12-18 months out as it’s easier to scale up than down.

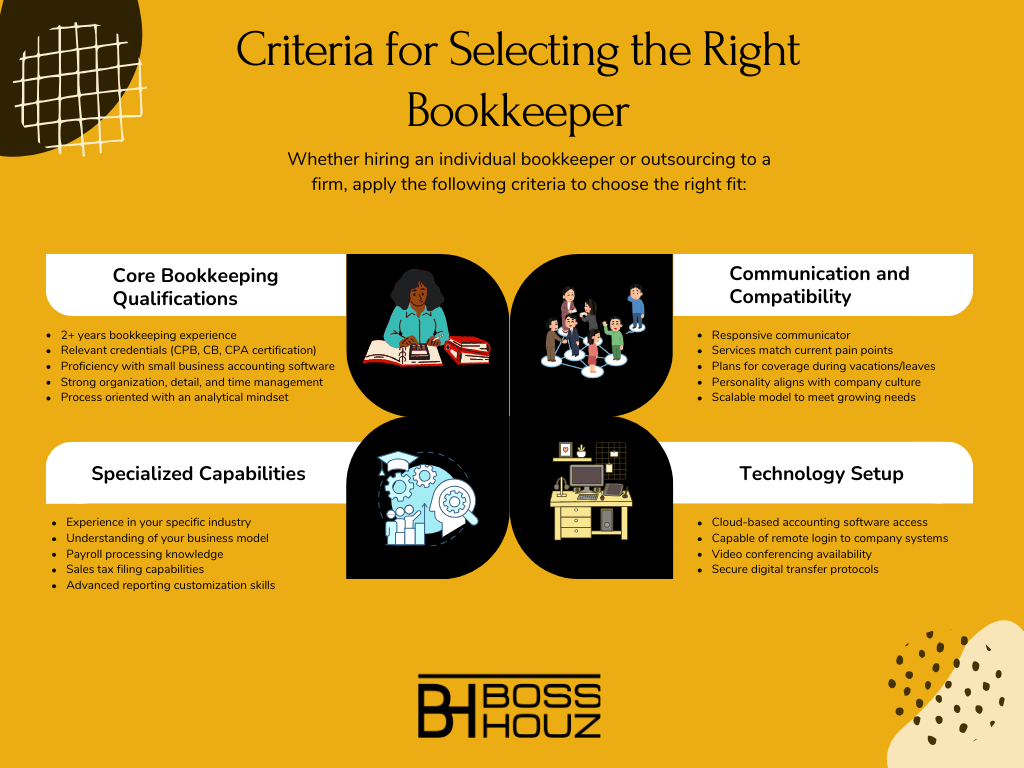

Criteria for Selecting the Right Bookkeeper

Whether hiring an individual bookkeeper or outsourcing to a firm, apply the following criteria to choose the right fit:

Core Bookkeeping Qualifications

- 2+ years bookkeeping experience

- Relevant credentials (CPB, CB, CPA certification)

- Proficiency with small business accounting software

- Strong organization, detail, and time management

- Process oriented with an analytical mindset

Specialized Capabilities

- Experience in your specific industry

- Understanding of your business model

- Payroll processing knowledge

- Sales tax filing capabilities

- Advanced reporting customization skills

Communication and Compatibility

- Responsive communicator

- Services match current pain points

- Plans for coverage during vacations/leaves

- Personality aligns with company culture

- Scalable model to meet growing needs

Technology Setup

- Cloud-based accounting software access

- Capable of remote login to company systems

- Video conferencing availability

- Secure digital transfer protocols

By prioritizing must-have capabilities from nice-to-have traits, you can zero in on the best person or firm to meet your needs.

Preparing to Hire a Bookkeeper

Before posting a job listing or calling bookkeeping firms, invest time organizing records and defining scope. This allows you to onboard efficiently and maximizes the value derived from services.

Financial Record Organization

Compile or gather access to:

- Bank statements

- Tax returns

- Payroll documents

- Invoices and sales records

- Receipts for expenses

- Loan/investment agreements

- Lease/asset contracts

- Current process documentation

Scope Alignment

Outline expected responsibilities like:

- Transactions processing

- Accounts payable/receivable

- Payroll

- Budgeting

- Financial statements

- Sales tax

- Managing software

Clarifying needs from the start minimizes mismatched expectations that lead to confusion or frustration.

The Hiring Process

Approach hiring a bookkeeper as you would a vital team member (because they are). Follow a systematic process:

1. Source Candidates

Leverage online job boards, local colleges, professional associations, your network, and LinkedIn to source qualified applicants.

2. Screen Resumes

Assess skills and experience relative to defined criteria. Flag promising candidates for interviews.

3. Interview Finalists

Devise a consistent set of ~10 questions that evaluate capabilities, fit, and communication style. Take notes on responses.

4. Check References

Speak with 1-2 past clients on work quality, reliability, and responsiveness.

5. Compare Proposals

For freelancers/firms, compare service offerings, pricing models, and value-added capabilities.

6. Make Selection

Notify top choice and finalize service agreement. Send regret notifications to other candidates.

While the process takes some weeks, it surfaces the best possible talent ready to tackle your financial records and empower strategic insights.

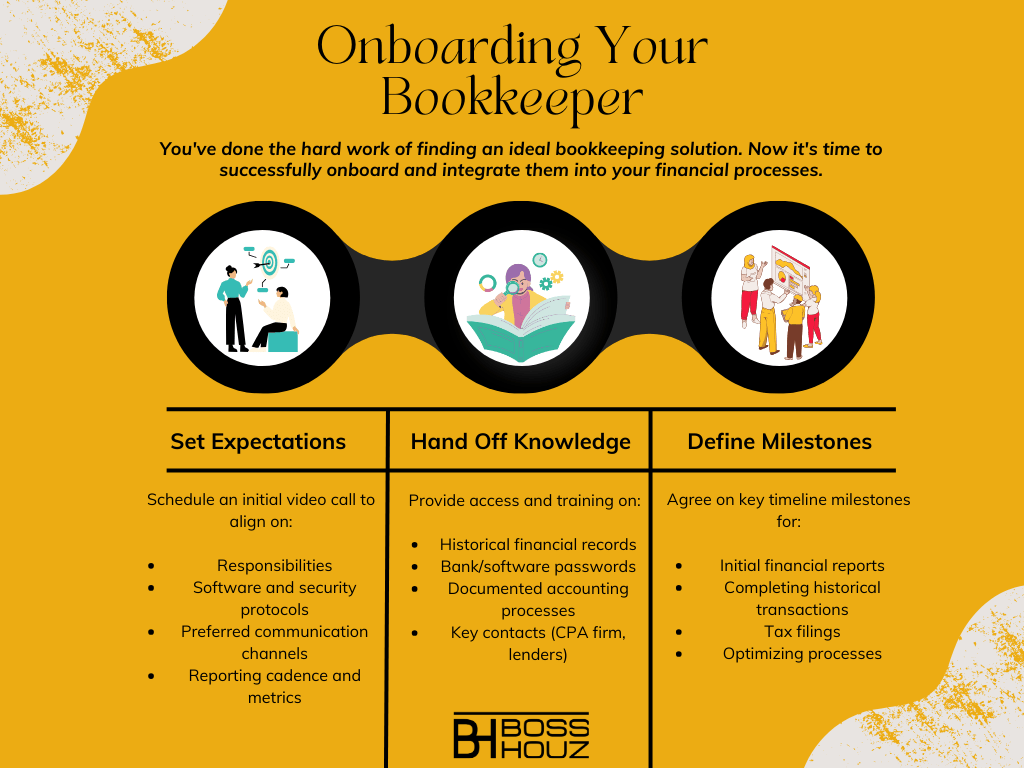

Onboarding Your Bookkeeper

You’ve done the hard work of finding an ideal bookkeeping solution. Now it’s time to successfully onboard and integrate them into your financial processes.

Set Expectations

Schedule an initial video call to align on:

- Responsibilities

- Software and security protocols

- Preferred communication channels

- Reporting cadence and metrics

Hand Off Knowledge

Provide access and training on:

- Historical financial records

- Bank/software passwords

- Documented accounting processes

- Key contacts (CPA firm, lenders)

Define Milestones

Agree on key timeline milestones for:

- Initial financial reports

- Completing historical transactions

- Tax filings

- Optimizing processes

By investing in a thoughtful onboarding, you empower your bookkeeper to quickly deliver value.

Maintaining a Productive Working Relationship

Ongoing collaboration with your bookkeeper ensures continually optimized financial operations as your business evolves.

Communicate Frequently

Schedule monthly check-ins to cover:

- Questions/issues

- Process changes

- Upcoming plans (new funding, expenses)

- Growth changes to scope

Treat Them as a Partner

While they manage finances, view your bookkeeper as integral to high-level planning around growth goals, strategic initiatives, and operational changes.

Formalize Growth Plans

As revenue, transactions, or business complexity grows, revisit if your current solution still fits or requires adjustment.

Protect Data

Only share essential financial information and keep passwords, contracts and agreements secure.

By regularly connecting and planning together, you develop a quality partnership that provides the foundation for data-backed decisions driving your small business growth.

Future Trends in Bookkeeping

While bookkeeping may seem like a stable profession, it sees continual evolution through technological disruption. As a small business owner, stay atop developments that may impact your financial management.

Automation

AI and machine learning will automate increasingly complex transactions and reporting, allowing bookkeepers to focus on high-value analysis and advisory.

Specialization

Look for bookkeepers specifically experienced in your niche to provide tailored insights beyond basic accounting.

Remote Work

Virtual bookkeeping firms will continue dominating through lower costs and centralized expertise.

Predictive Analysis

Bookkeepers will apply data analytics to spot financial trends, predict outcomes, and model growth scenarios.

Process Digitization

Blockchain, IoT sensors, and mobile connections will enable real-time accuracy in transaction capturing.

By choosing a bookkeeper well-versed in emerging technologies, you position your small business to tap into the latest advancements improving speed, accuracy, and insights.

Wrapping Up Hiring a Bookkeeper

As an entrepreneur or small business owner, you juggle countless responsibilities vital for growth and sustainability. It’s impossible (and ill-advised) to manage them all yourself. Knowing when to seek help not only provides work-life balance but empowers better financial decision making.

Hopefully this guide has shed light on optimizing that critical bookkeeping function. By aligning on the right bookkeeping solution for your current business needs and stage, integrating them effectively into systems and planning, and continually communicating, you can focus energy on higher-level strategy and execution confident someone has your financial records covered.

What steps will you take today to identify and hire the right bookkeeping support for reaching your small business goals?