Starting a partnership business is like getting married – you better know what the f**k you’re getting into, or it’ll end in a nasty divorce! But when done right, a solid business partnership can unlock serious growth potential and give you that much-needed edge in today’s cutthroat market.

This definitive guide will take you through the nitty-gritty of launching your partnership, from choosing the right partner to navigating the legal maze. We’ve got your back with pro tips, key takeaways, and real-world examples to keep you on track. Let’s dive in!

Key Takeaways

- A partnership is a business owned by two or more individuals who share profits, losses, and management responsibilities.

- Choosing the right partners, drafting a bulletproof partnership agreement, and understanding legal obligations are critical first steps.

- Proper business registration, financing, and operational planning set a solid foundation for growth.

- Open communication, conflict resolution strategies, and embracing digital transformation are vital for long-term success.

Table of Contents

Understanding Partnership Businesses: The Lay of the Land

Let’s start with the basics: what the hell is a partnership business, anyway?

In simple terms, it’s a business where two or more individuals come together as co-owners, sharing the profits, losses, and management responsibilities. Sounds pretty straightforward, right?

Well, not so fast. There are different flavors of partnerships to consider, each with its own set of rules and implications:

- General Partnerships: The OG of partnerships, where all partners have personal liability for the business’s debts and obligations. Risky, but simple to set up.

- Limited Partnerships (LPs): These have both general partners (who manage the biz) and limited partners (who are just investors with limited liability).

- Limited Liability Partnerships (LLPs): The fancy pants of partnerships, providing limited liability protection for all partners while still allowing them to actively manage the business.

Depending on your goals, industry, and risk tolerance, one of these structures might be a better fit than the others. Do your homework and consult a legal professional to make an informed decision.

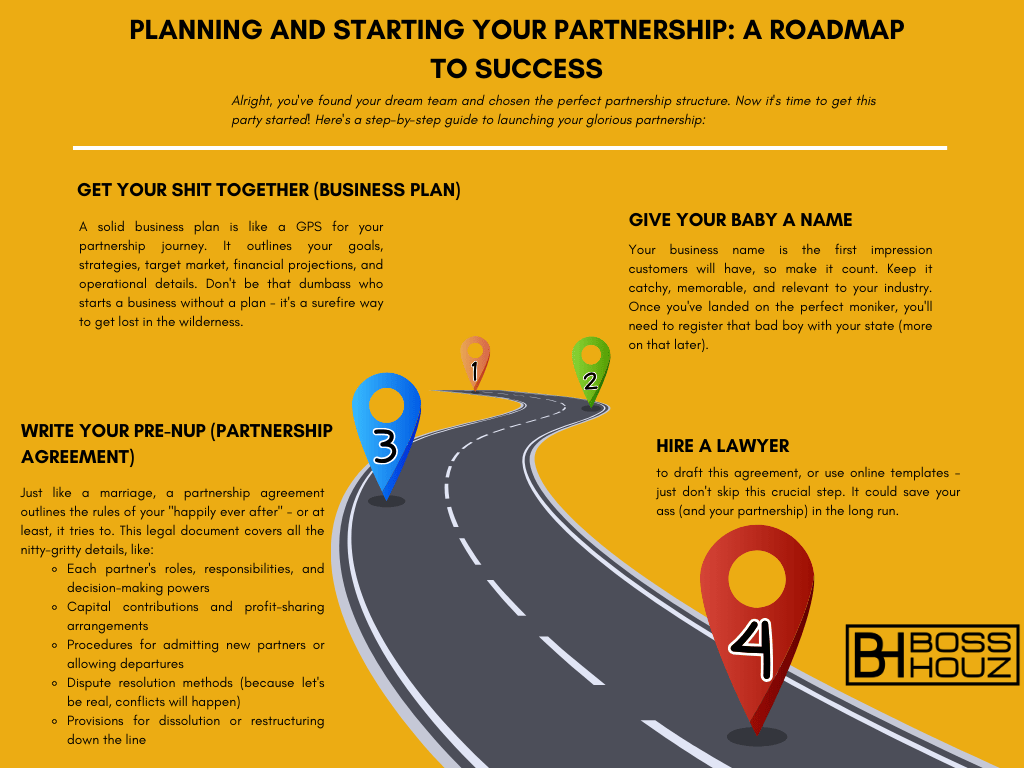

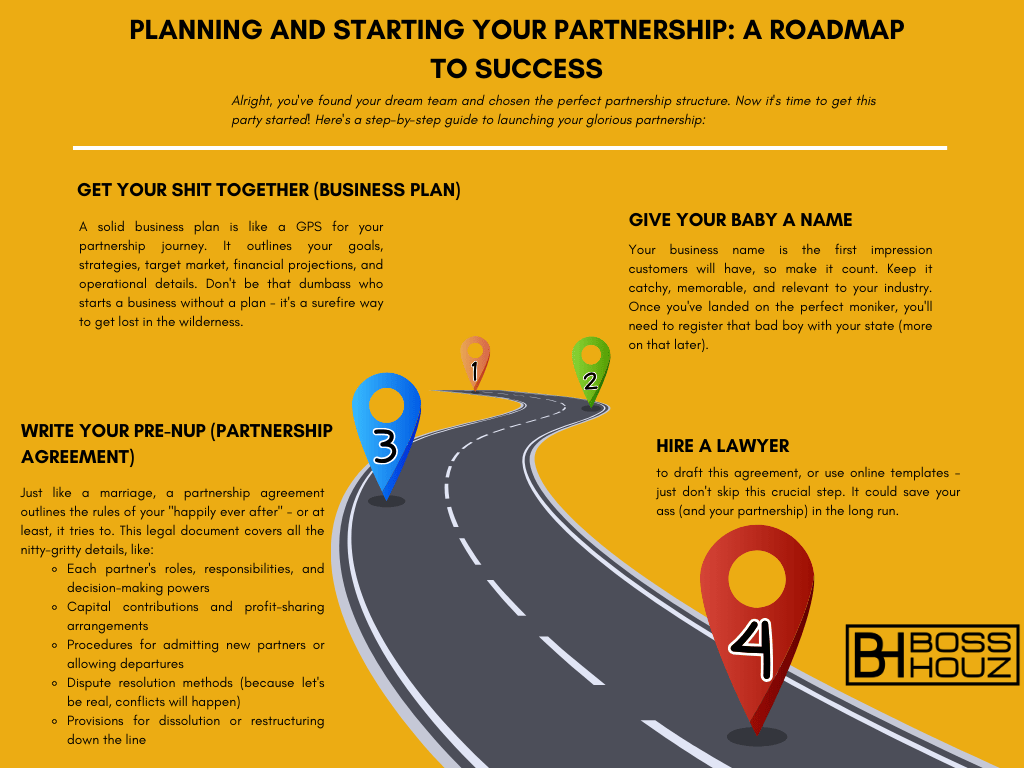

Planning and Starting Your Partnership: A Roadmap to Success

Alright, you’ve found your dream team and chosen the perfect partnership structure. Now it’s time to get this party started! Here’s a step-by-step guide to launching your glorious partnership:

- Get Your Shit Together (Business Plan)

A solid business plan is like a GPS for your partnership journey. It outlines your goals, strategies, target market, financial projections, and operational details. Don’t be that dumbass who starts a business without a plan – it’s a surefire way to get lost in the wilderness. - Give Your Baby a Name

Your business name is the first impression customers will have, so make it count. Keep it catchy, memorable, and relevant to your industry. Once you’ve landed on the perfect moniker, you’ll need to register that bad boy with your state (more on that later). - Write Your Pre-Nup (Partnership Agreement)

Just like a marriage, a partnership agreement outlines the rules of your “happily ever after” – or at least, it tries to. This legal document covers all the nitty-gritty details, like:- Each partner’s roles, responsibilities, and decision-making powers

- Capital contributions and profit-sharing arrangements

- Procedures for admitting new partners or allowing departures

- Dispute resolution methods (because let’s be real, conflicts will happen)

- Provisions for dissolution or restructuring down the line

- Hire a lawyer to draft this agreement, or use online templates – just don’t skip this crucial step. It could save your ass (and your partnership) in the long run.

FAQs

Q: What is a partnership business? A partnership business is a company owned by two or more people who share the profits, losses, and management responsibilities. It’s a way to pool resources, skills, and ideas to grow a business together.

Q: What are the different types of partnerships? The main types are general partnerships (all partners have personal liability), limited partnerships (with general and limited partners), and limited liability partnerships (providing liability protection for all partners).

Q: What are the advantages and disadvantages of starting a partnership? Advantages include shared resources, expertise, and financial burden. Disadvantages involve potential conflicts, joint liability (in some cases), and complexities in decision-making and management.

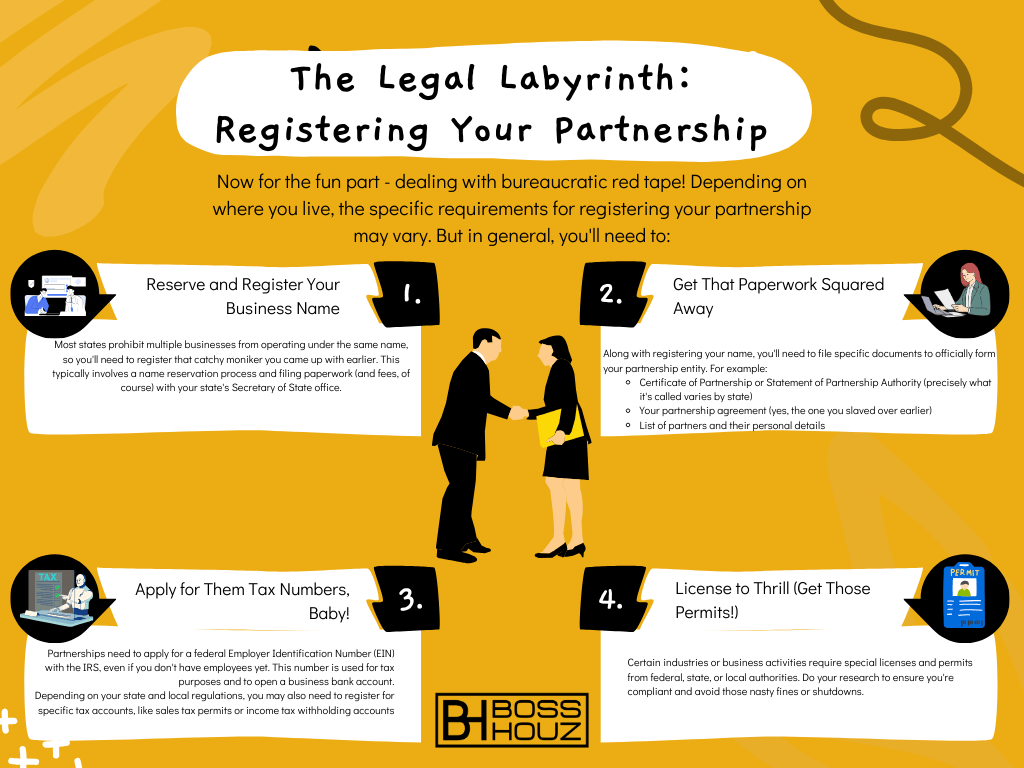

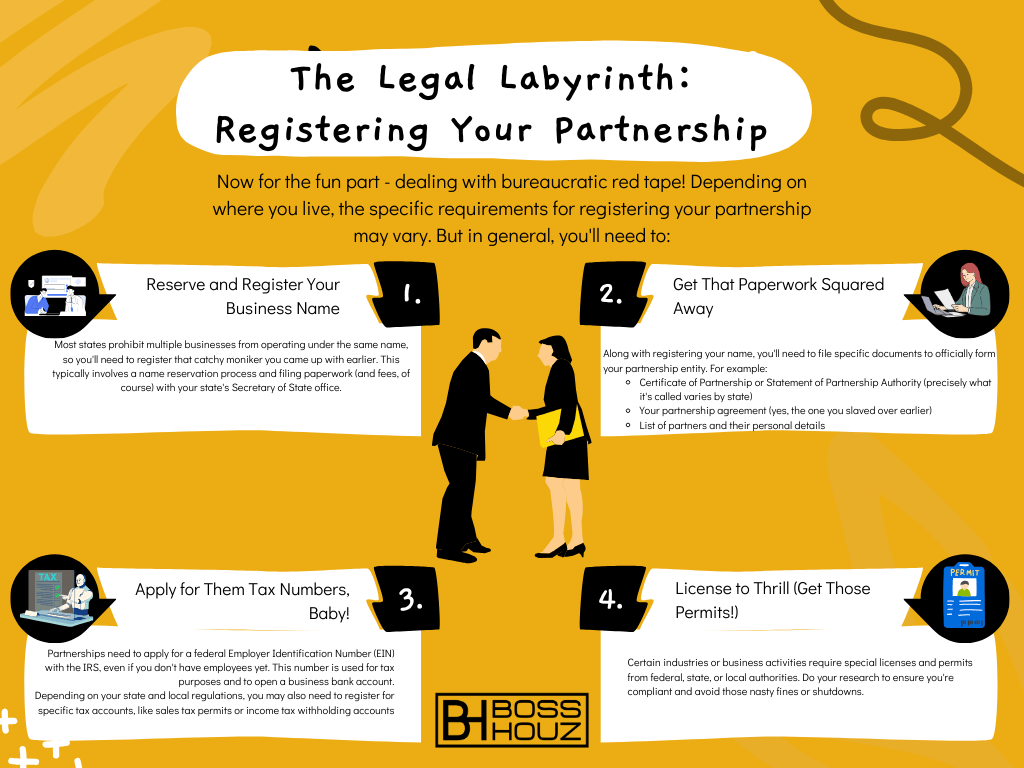

The Legal Labyrinth: Registering Your Partnership

Now for the fun part – dealing with bureaucratic red tape! Depending on where you live, the specific requirements for registering your partnership may vary. But in general, you’ll need to:

- Reserve and Register Your Business Name

Most states prohibit multiple businesses from operating under the same name, so you’ll need to register that catchy moniker you came up with earlier. This typically involves a name reservation process and filing paperwork (and fees, of course) with your state’s Secretary of State office. - Get That Paperwork Squared Away

Along with registering your name, you’ll need to file specific documents to officially form your partnership entity. For example:- Certificate of Partnership or Statement of Partnership Authority (precisely what it’s called varies by state)

- Your partnership agreement (yes, the one you slaved over earlier)

- List of partners and their personal details

- Apply for Them Tax Numbers, Baby!

Partnerships need to apply for a federal Employer Identification Number (EIN) with the IRS, even if you don’t have employees yet. This number is used for tax purposes and to open a business bank account.

Depending on your state and local regulations, you may also need to register for specific tax accounts, like sales tax permits or income tax withholding accounts. - License to Thrill (Get Those Permits!)

Certain industries or business activities require special licenses and permits from federal, state, or local authorities. Do your research to ensure you’re compliant and avoid those nasty fines or shutdowns.

Yeah, it’s a bureaucratic clusterfuck – but powering through these legal hoops is essential to keep your partnership legit and avoid potential legal landmines down the road.

FAQs

Q: Do I need a partnership agreement? What should it include? Yes, a partnership agreement is crucial for outlining each partner’s roles, responsibilities, capital contributions, profit sharing, decision-making powers, dispute resolution, and provisions for restructuring or dissolution. It helps prevent conflicts and protects all partners.

Q: How do I register a partnership business? The process typically involves reserving and registering your business name, filing formation documents like a Certificate of Partnership, applying for tax accounts and licenses, and fulfilling other state-specific requirements.

Money Talks: Financing Your Partnership

No business can survive without a steady stream of cash flow, and partnerships are no exception. Here’s the lowdown on keeping your finances in order:

Pooling Resources One advantage of a partnership is the ability to pool your financial resources together. Each partner contributes an agreed-upon amount of capital to get the business off the ground. This shared investment not only funds initial expenses but also demonstrates everyone’s commitment to the venture.

Accessing External Financing Despite your combined resources, you may still need additional financing for major investments, expansions, or working capital. Fortunately, partnerships have several options:

- Business loans: Banks and alternative lenders offer various loan products for partnerships, from term loans to lines of credit.

- Investment capital: Bringing in outside investors (think: angel investors or venture capitalists) can provide a cash injection in exchange for equity.

- Crowdfunding: Online crowdfunding platforms allow you to pitch your business idea and raise funds from a large pool of investors.

The key is presenting a solid business plan, demonstrating your partnership’s strengths, and effectively communicating your growth potential to lenders or investors.

Managing the Finances Once the money starts rolling in, you’ll need systems to manage it properly:

- Partnership bank account: Maintain a separate account for business income, expenses, and transactions – never commingle with personal funds.

- Accounting software: Invest in user-friendly accounting tools to track cash flow, invoices, payroll, and tax obligations.

- Profit and loss allocation: Outline how profits (and losses) will be distributed among partners in your agreement, based on ownership stakes or other agreed terms.

Remember, poor financial management is a leading cause of business failure – even for partnerships. Stay on top of your money game, and you’ll increase your chances of sustained success.

FAQs

Q: How do partners share profits and losses? The specifics should be outlined in the partnership agreement, but usually, profits and losses are distributed based on each partner’s ownership stake or capital contribution. For example, if Partner A owns 60% and Partner B owns 40%, profits/losses would be shared accordingly.

Q: How can partnerships get financing? Partnerships can access various financing options, including business loans from banks or alternative lenders, taking on investment capital from angel investors or VCs, and crowdfunding campaigns. A strong business plan and growth potential are key for securing funding.

The Partner Playground: Managing Your Crew

Sure, you’ve got a rock-solid legal foundation and the cash to get this party started. But the real challenge lies in effectively managing the day-to-day operations and personal dynamics of your partnership.

Divide and Conquer In any successful partnership, each partner should have clearly defined roles and responsibilities that leverage their unique skills and expertise. Maybe you’re the marketing guru while your partner is a coding ninja – divide those duties accordingly for maximum efficiency.

That said, it’s still important to maintain open communication and transparency around key decisions that impact the entire business. Nobody likes to be kept in the dark!

The C-Word: Conflict Resolution Conflicts are inevitable when you’ve got multiple stubborn founders calling the shots. Whether it’s a simple disagreement over branding or a heated debate about pivoting your entire strategy, you need a plan for resolving those clashes.

Your partnership agreement should outline specific procedures for dispute resolution, such as:

- Voting protocols and decision-making hierarchies

- Provisions for bringing in an impartial mediator or arbiter

- Mechanisms for partners to exit or dissolve the partnership (if conflicts can’t be resolved)

The key is addressing issues head-on through respectful dialogue and compromise. Letting resentments fester is a surefire way to breed hostility and jeopardize your partnership’s future.

Embrace the Digital Age In today’s fast-paced business world, partnerships need to stay agile and connected – even when the partners are scattered across multiple locations. Leveraging digital tools for communication, collaboration, and project management is no longer just a luxury; it’s a necessity.

Tools like Slack, Trello, Asana, and Google Workspace can keep everyone aligned on tasks, deadlines, and big-picture objectives. Virtual meeting platforms like Zoom let you hash things out face-to-face (or face-to-screen, rather) when in-person meetups aren’t feasible.

Don’t be that dinosaur still relying on ancient methods like fax machines and snail mail. Streamline your processes, boost transparency, and stay nimble by going full-on digital.

FAQs

Q: How do we manage finances and responsibilities in a partnership? Clearly define each partner’s roles, decision-making powers, and financial obligations in the partnership agreement. Maintain a separate business bank account, use accounting software, and agree on profit/loss allocation methods. Open communication is key.

Q: How can partners manage conflict effectively? The partnership agreement should outline dispute resolution procedures, such as voting protocols, bringing in mediators, or partnership exit/dissolution provisions. Addressing conflicts through respectful dialogue, compromise, and following agreed-upon processes is crucial.

Growth Spurt: Strategies for Scaling Your Partnership

You’ve made it past the initial growing pains and your partnership is thriving. But don’t get too comfortable – the real challenge lies in sustaining that momentum and taking your business to new heights.

Play to Your Strengths One of the biggest advantages of a partnership? You’ve got multiple skill sets and areas of expertise under one roof. Leverage those complementary talents to gain a competitive edge:

- If you’ve got a sales ninja and a branding mastermind, focus on expanding into new markets and product lines that combine their powers.

- Got a tech whiz on board? Prioritize digital transformation and implement cutting-edge solutions to streamline operations.

- Is one partner an industry veteran with deep connections? Put them on business development to forge lucrative strategic partnerships.

The possibilities are endless when you’ve got a well-rounded dream team – use it to your advantage!

Stay Ahead of the Curve The business world is evolving at a blistering pace, and partnerships need to stay agile to avoid getting left behind. Keep an eye on emerging trends, disruptive technologies, and shifting consumer behavior in your industry.

Conduct regular SWOT analysis (that’s Strengths, Weaknesses, Opportunities, and Threats for the uninitiated) to identify areas for improvement and potential growth avenues. Maybe it’s time to finally hop on that TikTok bandwagon and revamp your social strategy?

Whatever innovations or pivots your partnership pursues, make sure everyone is on the same page – diverging visions are a recipe for partnership disputes.

Embrace Your Values In this era of socially conscious consumerism, businesses can no longer afford to be apathetic about their impact on society and the environment. More and more, customers are choosing to support companies that align with their personal values.

Does sustainability matter to your target audience? Maybe weave eco-friendly practices into your operations and messaging. Is giving back to the community important? Consider partnerships with local non-profits or regularly donating a portion of profits.

Not only is this the right thing to do, but it can also give your partnership a competitive edge by resonating with values-driven consumers.

Have an Exit Strategy As morbid as it sounds, you need a plan for what happens if this partnership doesn’t work out in the long run. Shit happens – partners could have diverging visions, personal conflicts might become irreconcilable, or maybe you all just want to pursue different goals down the line.

Your partnership agreement should address provisions for restructuring, partner exits, or even full dissolution. Outline the specifics:

- How will remaining partners buy out a departing partner’s equity?

- What happens to the business assets and intellectual property?

- Are there any non-compete or non-solicitation clauses to prevent conflict?

Having these tough conversations upfront – and codifying the terms in your agreement – could save you from a world of legal headaches and fighting down the road.

FAQs

Q: What are some strategies for growing a partnership business? Leverage each partner’s unique strengths, embrace digital transformation and new technologies, explore new markets/products, prioritize sustainability and socially responsible practices, analyze industry trends, and have provisions for partnership restructuring or dissolution.

Q: What happens if a partner wants to leave the partnership? The partnership agreement should outline clear terms for partner exits, such as buyout provisions, handling of partnership assets/IP, and any non-compete clauses. Having these details predetermined can prevent messy disputes.

The Future of Partnerships: Adapt or Get Left Behind

As we look ahead, the landscape for partnership businesses is rapidly evolving, fueled by digital disruption, globalization, and shifting societal values. To not just survive but thrive in this new era, partnerships must embrace an adaptive, forward-thinking mindset.

The Digital Transformation Juggernaut Technology isn’t just changing how we do business – it’s redefining entire industries and business models. Don’t be the stubborn luddite who gets left behind; partnerships need to prioritize digital transformation as a core growth strategy.

Think beyond just having a website and social media presence. How can you harness cutting-edge solutions to optimize operations, enhance customer experiences, and future-proof your offerings?

Maybe it’s leveraging AI and machine learning for predictive analytics. Or perhaps exploring innovations like blockchain, IoT, or augmented/virtual reality that could disrupt your space.

Whatever the implementation, make digital a core pillar of your partnership’s DNA. Upskill your team, partner with tech companies who can help guide your transformation, and have an open mindset to adopting new, game-changing technologies.

Going Green for the Win In today’s climate (both literal and metaphorical), sustainability is more than just a buzzword – it’s a necessity for long-term business viability. Consumers are increasingly conscious of their environmental impact and flock to brands aligned with eco-friendly values.

For partnerships, this represents a prime opportunity to differentiate yourselves from competitors and build a loyal customer base of environmentally conscious buyers.

But it goes beyond just lip service and greenwashed marketing. Partnerships should look at implementing sustainable practices throughout their operations and supply chains:

- Prioritize energy efficiency and switching to renewable sources

- Reduce excessive packaging and single-use plastics

- Partner with local suppliers to shrink your carbon footprint

- Develop sustainable products and services tailored to the eco-conscious market

At the end of the day, embracing environmental responsibility isn’t just good for the planet – it’s good business sense in an era where sustainability sells.

Final Thoughts

Launching and operating a successful partnership business is no walk in the park. It takes hard work, meticulous planning, and the occasional beer-fueled argument to get it right.

But when you nail that magical combination of the right partners, a solid legal foundation, streamlined operations, and a keen eye toward future trends, a partnership can be an unstoppable force for business growth.