Are you a budding entrepreneur with an idea for a new business venture? If so, developing a strong business plan is one of the most important steps you can take towards making your entrepreneurial dream a reality.

A well-crafted business plan acts as a roadmap that outlines every aspect of your proposed company. It analyzes your industry, defines your products and services, and maps out a strategy for long-term profitability and growth. With a comprehensive business plan in hand, you’ll be prepared to launch your startup on a solid foundation.

But what exactly should your business plan include? The specific components can vary based on your business goals and audience. However, most plans contain the same core elements that provide a complete picture of your company.

In this article, we’ll explore the key pieces of a business plan, including:

- Traditional vs. lean business plan formats

- Must-have sections for every plan

- Step-by-step guide to writing each component

- Detailed overview of each section

- Emerging trends and innovations

- Real-life examples and success stories

- Actionable tips for crafting an effective plan

Let’s dive in and unlock the secrets to business planning success! With the right information and strategy, you can craft a winning business plan tailored to your unique needs as an aspiring homeowner entrepreneur.

Table of Contents

Understanding Business Plans

Before jumping into the components, let’s start with the basics: what is a business plan, and how is it used?

A business plan is a written document that outlines your company goals and how you plan to achieve them. It lays out your target market, competitive strategy, marketing plans, operations model, leadership team, financial projections, and funding needs.

Businesses use plans for a variety of reasons, including:

- Attracting investors: A strong business plan is essential for convincing potential investors that your company is worth funding. It demonstrates that you’ve done your homework and provides details on how their investment will be used.

- Securing loans: Banks and other lenders often require a business plan to approve financing. It helps them assess the viability of your business and the likelihood that you will repay the loan.

- Guiding strategy: A plan provides a roadmap for your company’s growth and direction over both the short- and long-term. You can use it to guide decision making and track progress.

- Refining ideas: The planning process helps refine your business concept, reveal flaws in your thinking, and identify potential opportunities or challenges.

- Assigning ownership: The plan acts as a touch point for assigning tasks and areas of responsibility across your founding team.

- Attracting key hires: Prospective employees are more likely to join your team when they can review your plan and vision for the company’s future.

There are two main formats for structuring a business plan:

- Traditional business plan: A lengthy, detailed document following standard sections in a set order. This is the more formal and complex option.

- Lean startup plan: A shorter, more fast-moving variation focused only on the most essential pieces for launching your MVP (minimum viable product).

The lean startup methodology has grown in popularity in recent years for its focus on iterating quickly based on customer feedback. However, the traditional business plan format remains widely used, especially by established companies and those seeking external funding.

For home-based entrepreneurs and small business owners like yourself, a lean startup plan is likely the best fit in most cases. The traditional format contains some components that are less relevant in early stages. We’ll touch on the differences between the two throughout this guide.

No matter which format you choose, every business plan should contain these four key elements:

- Executive summary: High-level overview of your business.

- Company description: Details about your company and what you do.

- Financial plan: Breakdown of your current finances and projections.

- Strategy and implementation: Your strategic plans and their execution.

With these core pieces covered, you’ll have a strong foundation for your plan. The order and exact components can be adapted to fit your specific needs and audience.

Now let’s explore a step-by-step guide to writing each section of a traditional business plan.

Step-by-Step Guide to Writing a Business Plan

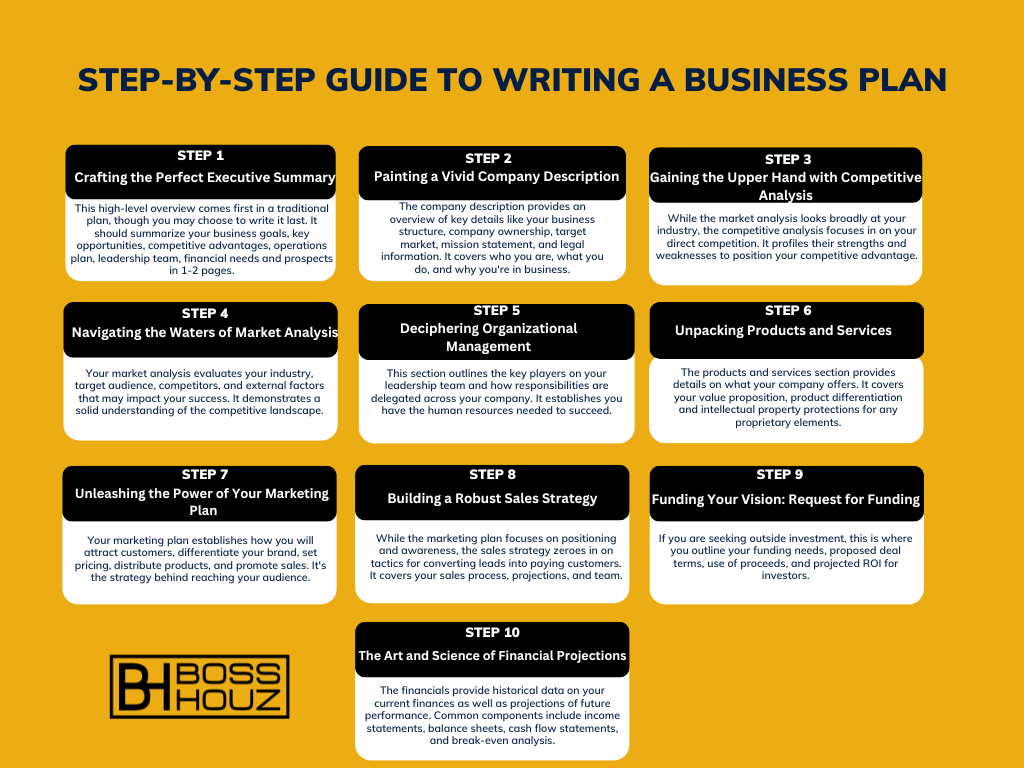

Crafting a comprehensive business plan can be a daunting process. Here is a simple 10-step guide to writing the key components:

Step 1: Crafting the Perfect Executive Summary

This high-level overview comes first in a traditional plan, though you may choose to write it last. It should summarize your business goals, key opportunities, competitive advantages, operations plan, leadership team, financial needs and prospects in 1-2 pages.

Step 2: Painting a Vivid Company Description

The company description provides an overview of key details like your business structure, company ownership, target market, mission statement, and legal information. It covers who you are, what you do, and why you’re in business.

Step 3: Navigating the Waters of Market Analysis

Your market analysis evaluates your industry, target audience, competitors, and external factors that may impact your success. It demonstrates a solid understanding of the competitive landscape.

Step 4: Gaining the Upper Hand with Competitive Analysis

While the market analysis looks broadly at your industry, the competitive analysis focuses in on your direct competition. It profiles their strengths and weaknesses to position your competitive advantage.

Step 5: Deciphering Organizational Management

This section outlines the key players on your leadership team and how responsibilities are delegated across your company. It establishes you have the human resources needed to succeed.

Step 6: Unpacking Products and Services

The products and services section provides details on what your company offers. It covers your value proposition, product differentiation and intellectual property protections for any proprietary elements.

Step 7: Unleashing the Power of Your Marketing Plan

Your marketing plan establishes how you will attract customers, differentiate your brand, set pricing, distribute products, and promote sales. It’s the strategy behind reaching your audience.

Step 8: Building a Robust Sales Strategy

While the marketing plan focuses on positioning and awareness, the sales strategy zeroes in on tactics for converting leads into paying customers. It covers your sales process, projections, and team.

Step 9: Funding Your Vision: Request for Funding

If you are seeking outside investment, this is where you outline your funding needs, proposed deal terms, use of proceeds, and projected ROI for investors.

Step 10: The Art and Science of Financial Projections

The financials provide historical data on your current finances as well as projections of future performance. Common components include income statements, balance sheets, cash flow statements, and break-even analysis.

That covers the 10 core sections that make up a traditional business plan format. Let’s do a deeper dive into the components that bring your plan to life.

Key Components of a Business Plan

Now that you understand the structure of a traditional business plan, let’s take a closer look at the purpose and details provided in each section:

Component 1: Executive Summary

As highlighted above, the executive summary gives a high-level overview of your entire business plan. Although it appears first, it’s often easiest to write this section last after you have defined all the details.

In just 1-2 pages, your executive summary should cover:

- Business concept and target market

- Major company milestones and achievements

- Competitive advantages and profitability drivers

- Summary of products and services

- Overview of operations and management team

- Current financial position and key projections

- Capital requirements and investment potential

This section is extremely important, as it’s often the only part stakeholders read before deciding whether to read further. Take the time to make it compelling and impactful.

Component 2: Company Description

Your company description helps investors understand the basics of your business operations. Key elements to cover include:

- Company mission statement and/or vision statement

- Business structure (LLC, partnership, corporation, etc)

- Ownership structure and key shareholders

- Company history and important milestones

- Number of employees

- Location and facilities

- Any intellectual property, trade secrets or key assets

Keep this section focused on an overview. You’ll dive deeper into products, services and leadership team in subsequent sections.

Component 3: Market Analysis

Before launching a business, it’s vital to understand the marketplace in which you will operate. The market analysis evaluates factors like:

- Relevant industry outlook, trends, and growth projections

- Total available market size and segmentation by demographics, geography, behaviors, etc

- Benefits the market seeks and problems that need solving

- Market barriers, risks, and opportunities that may impact customer adoption

- Macroeconomic factors, technological shifts, and regulatory issues that influence the overall environment

This section validates the need for your product within the current landscape. It demonstrates you grasp your target audience and market conditions needed to succeed.

Component 4: Competitive Analysis

After broadly looking at total market dynamics, this section zeroes in on your direct competition. Assess competitors on criteria like:

- Competitors’ product offerings, pricing, and market share

- Their strengths, weaknesses, opportunities and threats (SWOT analysis)

- How they differentiate vs. your planned differentiation

- Any barriers to entry or first-mover advantage

- How you will leverage your competitive edge

The competitive analysis positions your company firmly within the current competitive landscape.

Component 5: Description of Management and Organization

This section demonstrates that your business has the human resources needed for success. Key elements to cover include:

- Organizational structure (departments, hierarchy, management layers)

- Key roles and responsibilities

- Founder and leadership team backgrounds

- Staffing gaps that still need to be filled

- Any Board of Directors or strategic advisors

- How you plan to build out your team over time

Describing your management experience and acumen provides confidence in your operational abilities. Outside of your financials, the strength of your team is a top concern for investors.

Component 6: Breakdown of Your Products and Services

Here you’ll provide an in-depth look at what your business offers to the marketplace. Be sure to cover:

- Descriptions of your product/service features and benefits

- Details on any proprietary intellectual property or special sauce

- Current development status and plans for enhancements

- Any suppliers, patents, or specialized skills required

- How your offerings are differentiated from competitors

This section brings your products and services to life on paper. It’s your chance to get investors excited about what makes your business unique.

Component 7: Crafting a Winning Marketing Plan

Your marketing plan establishes the strategy behind how you will launch, promote and distribute your products to customers. Key elements include:

- Brand positioning and messaging

- Pricing model and tactics

- Sales and distribution channels (online, retail, etc)

- Promotional strategies (advertising, PR, referrals, etc)

- Partnerships and affiliate programs

- Customer retention tactics

This section demonstrates you have a sound strategy for attracting your target audience amidst the competition.

Component 8: Sales Strategy

While the marketing plan focuses on brand awareness, your sales strategy is all about converting leads into paying customers. Key elements include:

- Sales process from lead generation to close

- Sales team roles and responsibilities

- Sales projections by channel

- Customer acquisition costs

- Customer lifetime value

- Profit margins

- Tactics for optimizing sales performance

A smart sales strategy brings in revenue growth. This section proves you have it covered.

Component 9: Request for Funding

If you are seeking outside investment, this is where you outline your funding needs and proposed deal terms. Be sure to cover:

- How much funding you are seeking to raise

- How you plan to use the funds

- Proposed investment terms and structure

- Future rounds of funding needed

- Projected return on investment (ROI) timeline

- Exit strategy for investors (buyout, IPO, etc)

Having a specific funding request with deal terms instills confidence in potential investors.

Component 10: Financial Projections

No business plan is complete without the financials. Important elements include:

- Key assumptions and methodology

- Historical financial performance

- Income statement projections

- Balance sheet forecasts

- Cash flow statements

- Break-even analysis

- Profitability benchmarks

- Key business ratios

The financial projections prove your business model makes money. They demonstrate how wise investments will drive profitability.

That covers the 10 core pieces of a standard business plan. But depending on your specific situation as a homeowner entrepreneur, you may not need such an expansive plan.

For simple, low-cost business ideas, some sections become less relevant. We’ll explore a more streamlined approach next.

Diving Deeper: Business Plan Components in Detail

Now that you have a sense of the key pieces of a business plan, let’s take a deeper dive into what should be included in each section and why it matters. Follow along section-by-section to learn how to craft an effective plan tailored specifically for your home-based business.

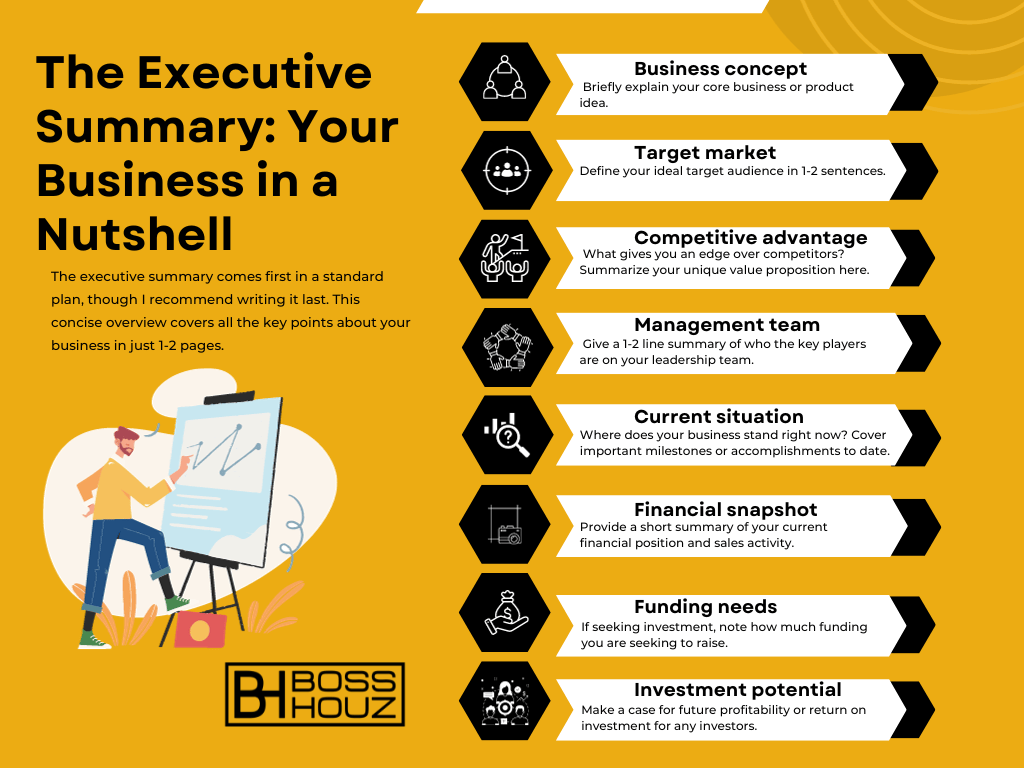

The Executive Summary: Your Business in a Nutshell

The executive summary comes first in a standard plan, though I recommend writing it last. This concise overview covers all the key points about your business in just 1-2 pages.

You’ll want to touch on these elements:

- Business concept: Briefly explain your core business or product idea.

- Target market: Define your ideal target audience in 1-2 sentences.

- Competitive advantage: What gives you an edge over competitors? Summarize your unique value proposition here.

- Management team: Give a 1-2 line summary of who the key players are on your leadership team.

- Current situation: Where does your business stand right now? Cover important milestones or accomplishments to date.

- Financial snapshot: Provide a short summary of your current financial position and sales activity.

- Funding needs: If seeking investment, note how much funding you are seeking to raise.

- Investment potential: Make a case for future profitability or return on investment for any investors.

Think of the executive summary as your elevator pitch. Use dynamic language to get readers excited about your business. This section sets the tone for the rest of your plan.

The Company Description: Who You Are and What You Stand For

After an overview, it’s time to go into more detail on the nuts and bolts of your company operations.

Some key elements to cover in your company description include:

- Mission and vision: Explain the guiding purpose and future vision for your business. What impact do you want to make?

- Company history: Share a brief timeline of how your business was founded and any key milestones.

- Business structure: Are you a sole proprietorship, partnership, LLC, corporation, etc? Explain your chosen business structure.

- Location: Where is your business located? Share details about your facilities and why you chose this location.

- Products and services: Provide a 1-2 line overview of your core offerings. Go into more detail later.

- Management team: List the key players on your founding and leadership team. Emphasize any particularly relevant experience.

For home-based businesses, don’t be afraid to start small in your company description. Share how you’re starting out of your home, but have plans to grow. The company description sets the stage for your grand vision.

Market Analysis: Understanding Your Industry and Target Audience

Before launching any business, it’s vital that you thoroughly analyze and understand the marketplace around it. Your market analysis should evaluate factors like:

- Industry outlook: Research your industry trends, growth projections, size, and opportunity. Make a case for a growing and vibrant market.

- Target customer profile: Define your ideal customer demographic (age, income, location etc) and psychographic (behaviors, values, interests) attributes. Go beyond surface demographics to show you truly understand your audience.

- Market size: Analyze the total size of your target market and projected growth. Estimate the share of the market you can realistically capture.

- Market needs: Explain the common needs, pains, and problems your target audience faces. Show how your business solves these issues.

- Market barriers: Identify any potential adoption barriers, like high costs or resistance to change, that may impact customer behavior.

- Industry challenges: Highlight any existing weaknesses, threats, or trends in the market that your business aims to address.

Back up claims with concrete industry data and market research sources whenever possible. Demonstrate you have a solid grasp on your competitive environment.

Competitive Analysis: Identifying Your Niche in a Crowded Space

Once you’ve assessed the broader marketplace, it’s time to analyze your direct competitors. Profile your competitive landscape:

- Competitors list: Identify your main competitors including long-standing players and new entries. Analyze their offerings, prices, strengths, and weaknesses.

- Competitor value props: What value are their products/services built around? How do they positioning themselves? Look for gaps in messaging you can fill.

- Market share: Determine approximate market share for major players. Gauge their relative foothold and customer base.

- SWOT analysis: Assess each competitor on strengths, weaknesses, opportunities and threats they are facing. Look for weaknesses you can capitalize on.

- Competitive advantage: Given your analysis, define your unique competitive advantage. Why will customers choose you over alternatives?

Your competitive analysis should reveal strategic gaps in the marketplace that your startup can fill with the right positioning.

Organizational Management: The People Behind the Plan

Bring your business to life on paper by profiling the key players who will make it a reality.

- Leadership team: Introduce the key members of your founding and management team. Emphasize experience and skills that will contribute to success in this business.

- Board members: If applicable, list any established business leaders or experts who serve as advisors or sit on your Board. Name recognition goes a long way.

- Organizational structure: Explain your company hierarchy, departments, and leadership roles. Provide an organizational chart if helpful.

- Staffing plan: Outline how many employees you hope to hire in the next 1-3 years. List key roles you

Here is the continuation of the article:

Products and Services: Building the Heart of Your Business

Diving deep into your products and services shows investors you have something worthwhile to offer. For each core offering, be sure to cover:

- Product/service description: Explain the key features and functionality that make your offerings useful to customers. Get into specifics.

- Proprietary elements: Highlight any unique intellectual property, secret sauce, or innovations that can’t easily be copied. Patents, proprietary tech, exclusive features etc.

- Development status: Detail the current stage of progress in building your offerings. Do you have an MVP to demonstrate?

- Product roadmap: Share your plans for future product enhancements and releases. This proves you have a long-term vision.

- Pricing strategy: Explain how you will price your offerings and why. Detail any bundled packages or tiered pricing plans.

- Value proposition: Summarize the core value customers will receive from your products. How do you make their lives easier?

- Distribution plans: Describe how customers will access your offerings. Will it be online, in retail stores, through an app etc.

Bring your products to life with specifics to get investors fired up. Paint the big picture of what you plan to build long-term.

Crafting a Marketing Plan: Capturing the Hearts of Customers

Your marketing plan should outline a comprehensive playbook for reaching customers with the right messaging across the appropriate channels. Cover these core strategies:

- Brand positioning: Explain how you will position your brand in the marketplace. What will make it stand out?

- Messaging: Detail the key messages, themes, and positioning statements you will use in marketing campaigns.

- Pricing tactics: Describe the pricing model and any promotional strategies for optimizing uptake. Will you use discounts, bundles, freemium versions?

- Distribution channels: Explain the sales and distribution channels you will leverage to put products in front of customers. Digital, retail, partnerships?

- Awareness building: Outline strategies like advertising, PR, referrals, and partnerships to drive brand awareness.

- Promotions plan: Highlight special incentives like promotions, contests, and referral programs to catalyze engagement.

- Retention strategy: Share your plans for retaining happy customers and growing their lifetime value through loyalty programs etc.

Your marketing plan should inspire confidence you can connect with customers in a crowded, noisy marketplace.

Sales Strategy: Turning Leads into Profit

While marketing focuses on awareness, your sales strategy is all about converting interest into profitable sales. Cover:

- Sales process: Walk through your sales process step-by-step from lead generation to close.

- Sales team structure: Explain the size of your sales team and roles. Provide an organizational chart.

- Sales projections: Forecast monthly, quarterly, or annual sales by product line/channel. Back up with historical data if possible.

- Customer acquisition costs: Estimate your average cost to acquire a new customer. This helps determine lifetime value.

- Profit margins: Determine your gross profit margin on each product/service. Factor in costs.

- Tactics for growth: Share proven tactics you will leverage to boost sales performance. Could include sales training, tools, bonuses etc.

Getting into the details of your sales process shows you have thought through how to turn prospects into satisfied, paying customers.

Request for Funding: Making the Ask

If you are seeking outside investment, this is your chance to specify exactly how much funding you need and how it will be used. Be sure to cover:

- Funding amount: State the exact dollar amount you hope to raise from investors.

- Use of funds: Specify how the funding will be used. Outline which business areas will benefit from the capital infusion.

- Offering terms: Describe the type of security being offered to investors – is it debt, equity, convertible notes? Include any rights or voting shares.

- Future funding: Disclose if you expect to need additional rounds of funding. Investors want to know their stake may be diluted.

- Returns: Project an expected ROI timeline for investors. When could they reach 2X, 5X, 10X their money?

- Exit strategy: How will investors eventually get their money back? Share plans for an acquisition, share buyback, IPO etc.

Having a well-defined funding request sets the stage for productive conversations with potential investors.

Financial Projections: Painting a Picture of Future Success

The financial projections help quantify your business goals and prospects for success. Essential financial statements include:

Income Statement – Projects future revenue and expenses by month and/or year. Ties to sales forecasts.

Balance Sheet – Forecasts assets and liabilities. Shows how your asset mix may evolve.

Cash Flow Statement – Estimates future cash inflows and outflows by month and/or year.

Break-Even Analysis – Calculates when total revenue will surpass fixed and variable costs.

Key Financial Ratios – Benchmarks for important ratios like gross margin, profit margin, return on assets.

Use of Funds Statement – If seeking financing, shows how those funds will be allocated.

Back up projections with factual support and clearly state all assumptions. Prove you have a model for profitability.

With those core business plan components complete, you have all the pieces needed to convey your business goals and operations to investors and lenders. But let’s not stop there. Next we’ll look at some emerging trends and innovations when it comes to business planning.

Wrapping up Key Components to a Business Plan

A comprehensive business plan is a pivotal tool for any aspiring entrepreneur. Following the guidance in this article, you can craft a strategic plan tailored to your unique home-based business goals.

Start with a lean approach focused only on the most vital components. Map out your target customers, competitive advantage, marketing strategy, operations, leadership team, funding requirements, and financial projections.

With each section, aim to inspire confidence in your capabilities and vision.

A clear roadmap will prove your startup is investment-worthy and built to thrive. Though preparation takes time upfront, a strong plan sets the stage to turn your dreams into reality.